it's hard to find a trade where you can avoid to feel like a laggard. this market is irrational or it was irrational couple of moths ago, now it's unreal.

anyway here are some ideas...

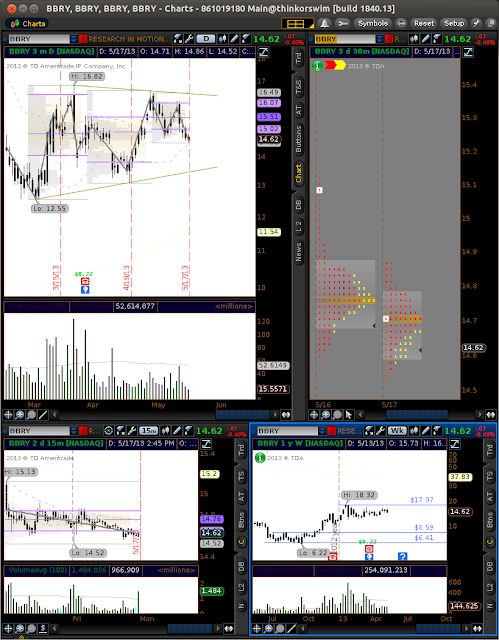

BBRY

->i would look for a neutral/slightly bullish if it goes a bit lower

->with IV percentile in 25% considering the 52 weeks IV but higher then the recent HV we could choose some credit strategy though, depends where is the entry and the view.

SPWR

->potential weakness

->kind of the same image in TSLA

->gold is at previous low made few weeks ago, i opened a long trade on Friday but i closed it right before market close. i saw poor demand reaction and we closed on the low on higher volume...

->euro is at strong demand area, could be a good opportunity to get long...

anyway here are some ideas...

BBRY

->i would look for a neutral/slightly bullish if it goes a bit lower

->with IV percentile in 25% considering the 52 weeks IV but higher then the recent HV we could choose some credit strategy though, depends where is the entry and the view.

CAT

->it seems like last week we tested the previously bottom reversal at the demand area, we had some weakness last week though...

->with implied volatility at 21% and lower than HV some time of debit spread would fit better

EBAY

->is at strong supply area, it could be an opportunity here.

->IV=23.82% > HV. Friday we traded more considerably more puts than calls compared with the week, this could not mean much though...

INTC

->potential weakness

->kind of the same image in TSLA

->gold is at previous low made few weeks ago, i opened a long trade on Friday but i closed it right before market close. i saw poor demand reaction and we closed on the low on higher volume...

->euro is at strong demand area, could be a good opportunity to get long...

Comments

Post a Comment